Bitcoin is a peer to peer network that anyone can participate in. It enables you to securely store value over time and to transfer that value to anyone else at any time without the need for a third party. It has a fixed and transparent inflation schedule that cannot be changed at will like ‘regular’ money. It is cash, for the internet.

Alice sends a transaction from her wallet which is received by 1000’s of network participants who tell each other that Alice wants to send to Bob. The transaction is seen by a miner who dedicates computing power to group Alice’s transaction into a block along with lots of other transactions. Once Alice’s transaction is mined into a block, Bob will have the corresponding amount of bitcoin in his wallet.

The world learned of Bitcoin in 2009 when an anonymous online entity called ‘Satoshi Nakamoto’ shared the Bitcoin White Paper to an online mailing list. Satoshi disappeared in 2011 and has never been seen online since. In the years since, hundreds of developers worldwide have continued to contribute to and improve the Bitcoin protocol.

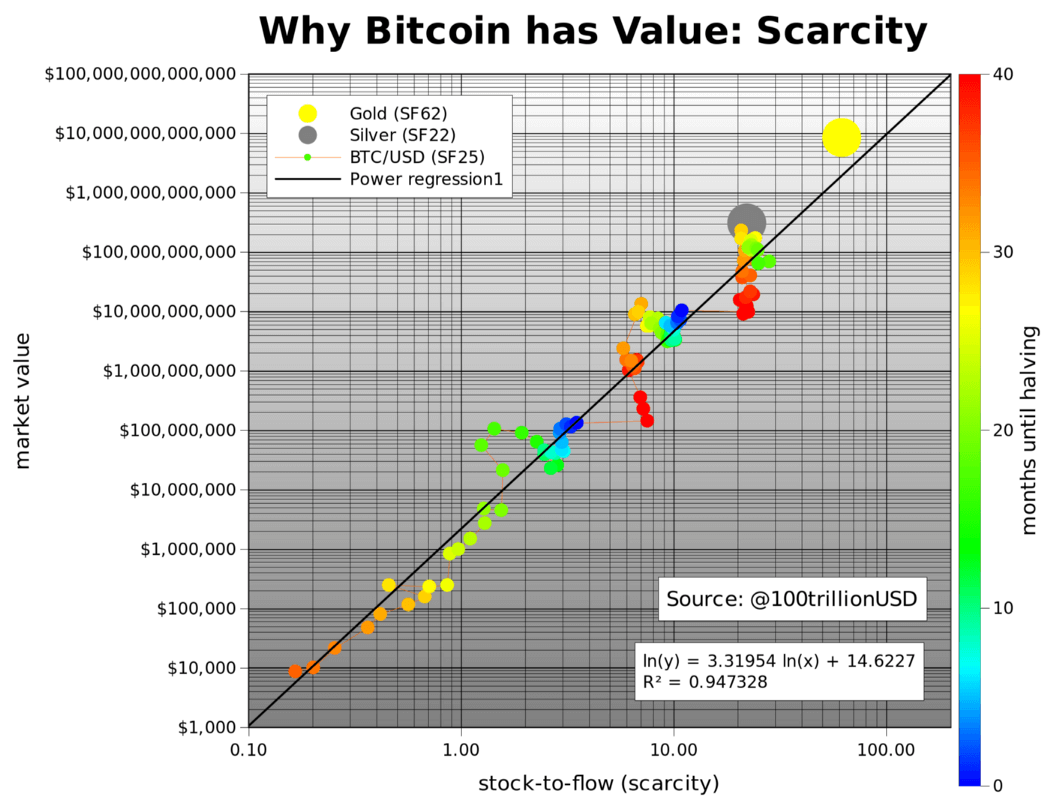

It is scarce (there will only ever be 21 million) and this can be verified by anyone with a $30 single board computer. It has an immense amount of computational power dedicated to securing its distributed ledger. The network literally pays people to protect its integrity and act in good faith. Bitcoins ‘price’ in $ or £ terms is determined by simple market supply and demand.

Put simply, everyone and no-one. Everyone is in control of their own participation in the network and the network is structured so that bad actors cannot succeed. No single developer can incite any changes to the code. No one miner can censor specific transactions. No single user can cheat the system and spend Bitcoin they don’t have or that does not belong to them.

The blockchain is a public ledger that contains a copy of every single bitcoin transaction ever completed. Miners compete to produce blocks for transaction fees and a block subsidy. Each successful block is cryptographically linked or ‘chained’ to its predecessor.

Some countries have tried to regulate it, control it, shut it down, etc. but none of them have succeeded. They mostly just seem to want to use the existing central bank system to control how people trade fiat currencies for Bitcoin, and of course they want to tax Bitcoin in whatever way possible.

If you zoom out the price chart, you will see that Bitcoin has been steadily going up in value since it was created, trading at less than $0.01 and slowly climbing to over $20,000 USD at its most recent peak at the end of 2017.

This is because its supply is fixed and people value its scarcity. With more demand and a fixed supply, prices go up over time. As the years go on, its value will continue to increase as new users start holding Bitcoin.

At the time of writing there are a little over 18 million bitcoins that have been mined. There will only ever be 21 million and the final one will be mined around the year 2140. Each bitcoin can be subdivided into 100 million Satoshis or ‘sats’ so there are plenty to go around.

New bitcoins are created as a result of the globally distributed and highly competitive mining process. Each newly mined block rewards the successful miner with a subsidy. At the time of writing, this subsidy has just been halved to 6.25 bitcoins. It will halve again to 3.125 bitcoins after another 210,000 blocks or roughly 4 years.

The process of participants contributing large amounts of computing power to process transactions into blocks. Once they have grouped these transactions a miner performs a repetitive computational task on them to try and find an answer that is below a certain target. If they are successful, the block is mined and the miner receives the transaction fees and block subsidy. The process then starts again and the next batch of transactions.

Please see herefor some recommendations.

Original Source written by BitcoinQ_A